TF Capital partners with visionary founders and teams building groundbreaking biotech companies from inception to global impact.

Founded in Shanghai in 2014, TF Capital is a dual-currency, specialized in early-stage biotech investment firm.

By combining strategic capital with pioneering industry expertise, we empower biotech innovators to transform science into impactful solutions—delivering sustainable returns to our investors.

Why Partner with TF Capital

Close Collaborations

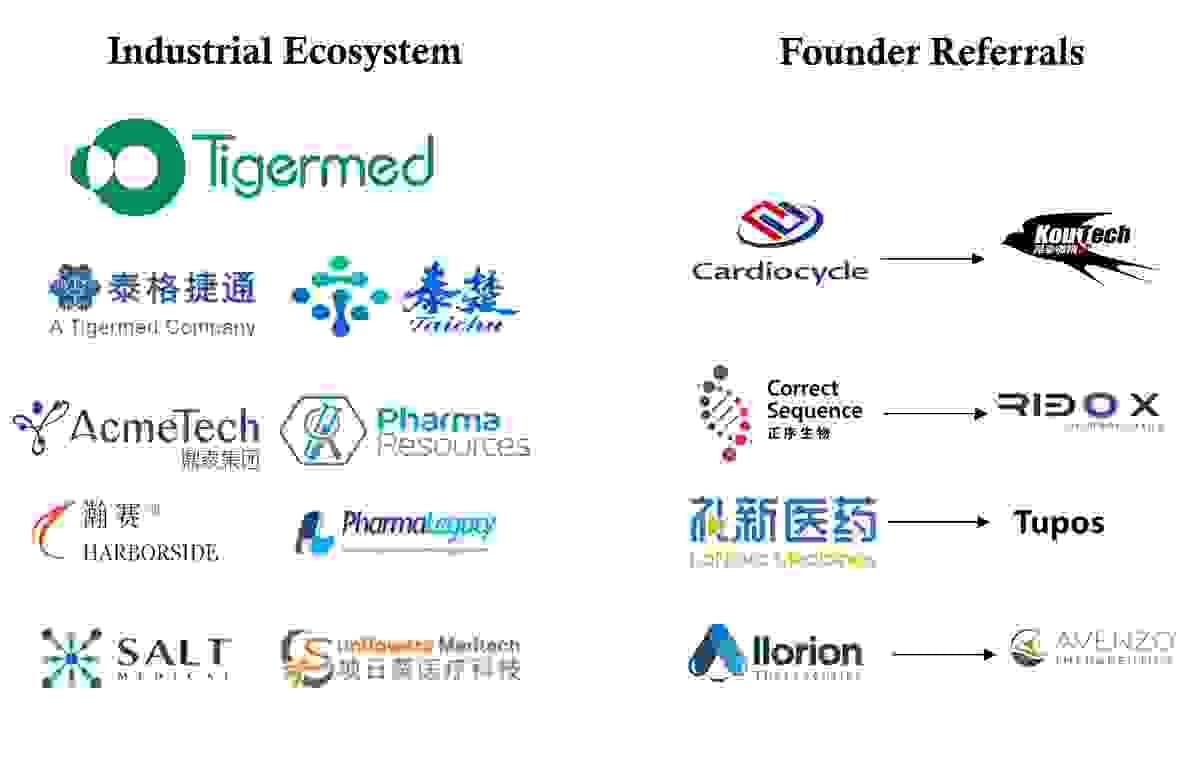

Through our sourcing strength, we pursue high-conviction opportunities with a focused strategy, delivering substantial value to our partners.

Active

Investment Strategy

Combining US innovation with China’s cost efficiency is the best way to maximize valuee

1Target high-barrier, biologically-differentiated assets

2Invest in scalable technology platforms for diversified pipelines

3Leverage early expertise to capture pre-IPO exit value

Domintating

License-Out Landscape

In 2023

TF Capital demonstrated exceptional investment performance by securing 5 of the Top 15 highest upfront payments in China’s innovator drug license-out transactions.

Key highlights from this elite group include:

- Cellular Biomedicine Group (C-CAR039/C-CAR066) partnered with Johnson & Johnson with an upfront of $245 million

- Eccogene (ECC5004) licensed to AstraZeneca for an upfront of $201 million

In 2024

Upfront payments from TF portfolio companies accounted for 37% of China’s total ($4.1B), underscoring our ability to drive high-value transactions.

Landmark deals such as:

- LaNova Medicines → MSD: $588M upfront

- Regor Pharmaceuticals → Genentech: $850M upfront

- Eccogene → AstraZeneca: $185M upfront (GLP-1 program)